The above references an opinion on Bitcoin upcoming awakening and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.

Either you look at short-term data or long-term fundamentals, Bitcoin (BTC) is going to appreciate massively in the coming years. And yes, as you may have guessed it by now, Bitcoin is awakening. Data from the derivative market looks bullish for BTC in the near period. For a long-term-oriented investor, the fundamentals have never looked so promising.

In hindsight, you will regret not buying Bitcoin now.

Perfect fundamental set up ever

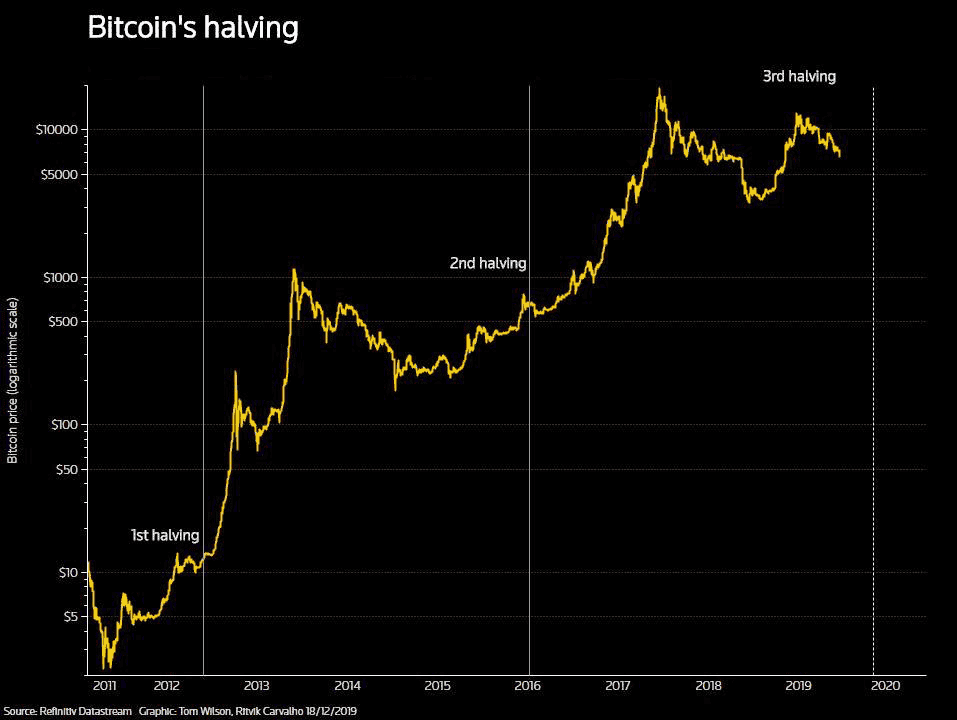

Bitcoin’s time to shy as a “safe haven” will be examined in this crisis. We at Crypto Infos see the coming period affected by GDP contraction and the upcoming expansionary monetary mayhem the perfect environment for a deflationary alternative “safe haven” such as Bitcoin. The halving, which will approximately happen around April 2020 will be the final catalyst launching BTC at a new all-time high.

Coronavirus is a serious business for the markets. If governments around the world are shutting down their country, then economic activities will come to an end – period. Basically, the longer the shutdown, the more severe the contraction in GDP. So, it is not surprising, that all markets dropped like stones.

The meltdown was severe with the Dow Jones hitting $19’174 on Friday close on 20 March. Previously on February 12, the Dow has peaked at $29’551, which indicates a 35% drop in value.

The S&P 500 finished at 2’304 points last Friday. Even the “safe haven” assets could not profit from the risk-off sentiment. Gold plunged 13% from its peak at $1’700 on 8 March to $1’490 (20 March). Bitcoin got hammered -41% from $7’320 (12. March) to $4’300 (13. March) overnight but recovered already to $6’000 (22. March).

However, are not “safe haven” assets supposed to withstand and gain in this massive sell-off events?

Chart 1: Index; data from Yahoo.Finance

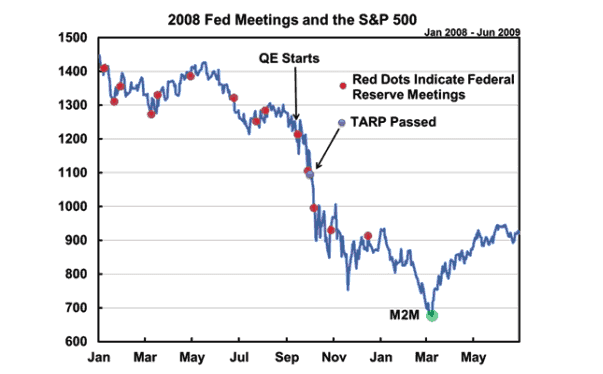

They will eventually rise. However, even “safe haven” assets such as Gold and Bitcoin get hit severely by a liquidity crisis like we just observed in the last weeks. One only must compare with a historical event such as the Great Financial Crisis in 2008.

Firstly, markets corrected sharply because of the Lehman Brothers’ downfall. Investor sentiment was mainly seeking liquidity and was selling whatever asset was available (see chart 1). Prior to the collapse of Lehman Brothers, Gold has already lost a fair amount of its value.

The bankruptcy of Lehman Brothers (15.09.2008) marked the short-term top of Gold ($880), which then fall to $710 (-20%) at the end of October 2009. However, this marked the bottom, the attribute of being a “safe haven” overturned the effect of panic selling and Gold turned bullish.

While the S&P 500 was still suffering, Gold started its two years rally to an all-time high $1’870 in October 2011. Was the expansionary monetary policy another catalyst for Gold, which serves as sound money in inflationary times?

are not “safe haven” assets supposed to withstand and gain in this massive sell-off events?

Such liquidity crisis is always deflationary in the short-term until the moment when central banks start responding (printing money) by lowering the interest rate to near 0, buying up Treasuries and Bonds (Quantitative Easing) in hope of encouraging real-world investment.

For better understanding, we will elaborate on monetary policy theories further. The whole debate about the Great Financial Crisis and the effectiveness of these before-mentioned actions taken is still not settled between Keynesian’s, Chicago School and Austrians School Economists.

Mainly, the Chicago and Austrian Schools want as little intervention in the economy as possible, because eventually real economic growth can only come from individuals, consumers and entrepreneurs interacting freely. Additionally, the Austrian School highlights the necessity of sound money and thus stands close to Bitcoin.

Also, a vast majority of Austrian Economists came out in favor of Bitcoin being “Digital Gold”. Crypto Infos does not have a clear opinion in this controversial debate. Frankly, the economy is not real science, because who is able to model the behavior of humans en masse? Nevertheless, we have to start from somewhere and conclude our findings based on the Chicago and Austrian School, that real economic growth cannot come from expansionary central bank policy, the former only creates boom and bust cycles and fiat money ultimately always suffers devaluation until zero.

The author also likes to quote economists at First Trust Advisors, which strongly disagree with the common wisdom (Keynesianism), that expansionary monetary policy can stimulate the economy.

Based on First Trust’s analysis (see Chart 2) neither Quantitative Easing (QE) nor the Troubled Asset Relief Program (TARP) by the Treasury Department could reverse the downfall.

Only the suspension of Mark-to-Market rule eventually turned the markets. All the liquidity provided by central banks found its way into the stocks, bonds, real estate and gold market creating massive asset inflation.

Currently, our policymakers seem to go the same path again. In a surprise meeting the FED already slashed rates to zero, President Trump signed an approximately $100 Bio “Emergency Relief” bill. Another proposal is to send $1’000 to every American and $500 to every child asap. We just wrote history: We have the first kind of helicopter money! In addition, the Government delays the tax filling to July and defers the payments of student loans. Everything aggregated the USA alone is about to spend over 1 Trillion US-Dollar. The European equivalent (ECB) starts pumping €750 Bio into the economy and promises to come up with further measures. So far monetary mayhem is coming as it has never been before.

Furthermore, in April the miners’ reward will drop from 12.5 BTC to 6.25 BTC. Based on our assumption, this excessive liquidity will not reach the real economy such as argued by First Trust Economists. We might see the biggest influx of money coming into the Bitcoin market. The negative supply shock, due to the halving will meet an increasing demand side, which eventually should let the price of BTC surge.

Bitcoin’s awakening is Now

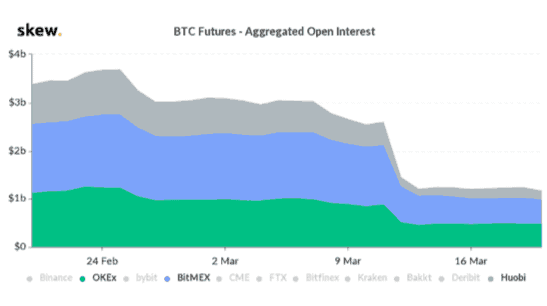

Meanwhile, the speculators are still bearish for BTC as best seen in the future market. Open interest is used as an indication of activity. In our case, open interest in BTC futures on the three major exchanges fell to a new low.

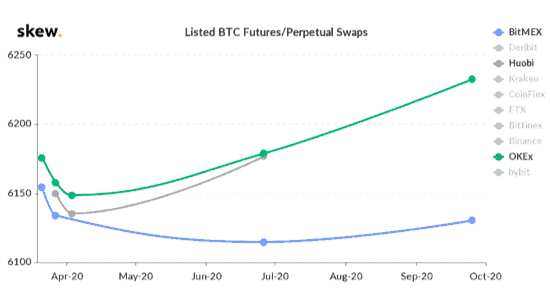

Normally, a buyer of a futures contract must pay the spot price plus the basis. The basis is mainly the opportunity cost of the seller, who must hold the asset and is not able to collect the risk-free rate. In this market (contango; upwards slope) the future prices are higher than the actual spot price.

If this is reversed (spot price > future price) the market is in backwardation. In our case, we can observe that futures in short – and mid-term maturity are trading lower than the actual spot price. Thus, speculator sentiment is extremely bearish from the short-term perspective and a normal move upwards can easily trigger a massive short squeeze.

The speculators are way too bearish in the short- and mid-term outlook, which indicates that BTC could quickly pump upwards.

In addition, we will see a negative supply shock hitting on increasing demand. Never has the fundamentals and speculators sentiment indicated a better opportunity to buy the True King Bitcoin.

I believe that on the one hand, bitcoins are like regular money, they can be exchanged for dollars, euros, rubles, etc. You can use them to make purchases on the Internet. On the other hand, bitcoin is losing ground and alternative cryptocurrencies are taking its place. For example, Monero, Ethereum, CRP from the UtopiaP2P ecosystem.