Executive Summary

Kusama was founded in 2019 by Gavin Wood, Polkadot founder, and former CTO and founder of Ethereum. Kusama Network is referred as Polkadot’s Canary Network, an experimental version of its ‘cousin’ network: Polkadot.

Built on Substrate and working independently from Polkadot network, Kusama uses nearly the same codebase as Polkadot.

Kusama core mission is to test the interoperability and scalability of functionalities and to organize these solutions into a network of parachains -or parallel chains.

Kusama Key Metrics

(As of May 24th 2021)

| Ticker: KSM |

| Price: $324.38 |

| Max Supply: 10,000,000 |

| Circulating Supply (Est.): 8,470,098 |

| Market Capitalization: $2,677,178,636 |

| Market Rank: #39 |

| ATH: $595.25 (14/05/2021) |

| YTD Perf: +340.6% |

| 1Y Perf: +4,767.6% |

| ROI: 19,102.95% |

| Staked on Network: 5,427,300 (48%) |

| Returns: 15.1% |

Valuing Kusama

Polkadot and Kusama aim to reach the same goals from a Blockchain added value analysis perspective, and therefore, they will be considered similar for the following valuation proposal.

Both blockchain networks have been built to enable Web 3.0, a decentralized and fair internet in which users have full control over their data.

In a time when cross-chain composability and scalability have never been more important, both of these networks launch parachain auctions, and crowd loans, a way to source tokens for parachain bids in which users can withdraw the tokens invested after the retirement phase (end of the lease period; from 6 to 24 Months.

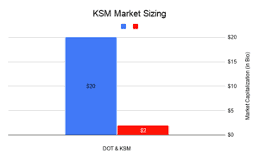

The figure below shows that DOT is valued at 10 times more that its native Blockchain ‘cousin’ token, Kusama. The value of a crypto asset is often closely tied to the fundamental demand for the platform, in this case Polkadot.

| BTC Market Cap | $707 Bio |

| ETH Market Cap | $297 Bio |

| DOT Market Cap | $21 Bio |

| KSM Market Cap | $2 Bio |

Agency ratings see Polkadot as one of the best layer-1 protocols in the crypto-verse, the later experienced a meteoritic rise to the top ten according to market capitalization in a matter of just few months.

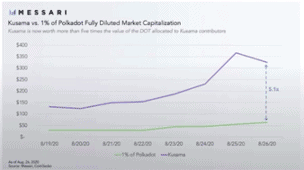

Research highlight KSM and DOT projects similarities the same way LTC has been a segregated witness fork for BTC in 2011.

Following the same approach, the below chart depicts the quintupled value KSM reached once 1% of Polkadot market capitalization has been diluted. In other words, Kusama is trading at a 600% premium to 1% of Polkadot’s market cap.

Risks

Technological Risks:

To a certain extent, Kusama can be considered as a testnet with lower security levels than Polkadot network. Early and unaudited yet, Kusama participants can take an active role on the network and participate in Kusama NPoS. KSM holders can as well try on-chain governance by proposing and voting on referrals as well as becoming a council member.

Adoption Risks:

KSM has been designed in a way such that only a certain number of slots are available , approximately 100, although future optimizations (namely secondary relay chains) will increase this number further. It has been reported that more Dapps need to be working and performing as good or even better than Ethereum counterpart.

Compliance Risks:

Once Kusama network has been originally fully deployed, Web 3 Foundation stopped retaining fundamental control of it by removing a specific module. The Governance will then shift to tricameral model namely the Referendum Chamber, the Council and the Technical Committee (Referendum Stake Weighted Participation) providing strong incentives for participants to hold and lock the tokens for a pre-defined amount of time.

Kusama – Author’s Opinion

Backed by a strong team of visionaries’ engineers with decades of experience in Computer Systems, Software Engineering and Security Networks, coupled with a worldwide rooted community expanding at the speed of light, Kusama has bright days ahead. The ‘Canary Network’ positions itself as scalable multi-chain network for innovation and an ‘early-stage test-net’ for Polkadot deployments. The added value and benefits from this combination include:

-less traffic congestion and higher levels of security on mainnet thanks to fast possible iteration

-ability to live as an independent community network

-entirely owned and governed by KSM holders

-low barriers to entry for deployment

-low bond requirements for validators and parachains

-low slashing penalties

The network adoption by interested parties and the evolution of the coin governance within the next few semesters will give a clearer idea on the future of Kusama as well as hurdles it will encounters.

References (Selection):

CoinGecko; Coinmarket cap; https://polkadot.js.org/; Weiss Ratings; Messari