This last quarter of 2020 has seen large market gains alongside both excitement and criticism of the Ethereum platform. The first phase of the 2.0 update has been successfully implemented and an increased throughput is expected to solve historic problems of scalability and cost. However, some critics hold valid concerns and there are still several challenges to overcome on the evolutionary road ahead.

Crypto Infos is a Swiss-based agency specialized in Blockchain technology adoption, Cryptocurrency news, and Web3 jobs. Crypto Infos launched in 2020 its flagship product and service: ‘Crypto & Blockchain Jobs Partners‘, a Blockchain Jobs platform to democratize crypto careers and connect Web3 talents to corporates and start-ups.

Ethereum: Scalability and Costs

Many know Ethereum as the leading blockchain protocol with smart contract capability. It was established in 2015 as the first public distributed ledger to widely enable token creation following an initial coin offering of pre-mined ETH. However, this market dominance and the near-global monopoly on token issuance has been increasingly challenged since 2017, and for good reason.

There are several flaws in blockchain systems that rely solely on a proof-of-work (PoW) consensus mechanism. The development of expensive ASIC hardware that is tailored to a broader range of algorithms inhibits access and profitability of individual or retail miners. The process is an extremely inefficient use of energy and the growth of mining pools will ultimately undermine the security and transparency benefits of a decentralised network. A majority of the Bitcoin network is now controlled by just five pools, with 65% of the total hashrate estimated to reside within Chinese borders, so collusion between nodes is not the impossibility that it once was.

However, while there is a strong and valid argument that Bitcoin and similar systems are too big to fail, the most common criticisms of Ethereum have been scalability and cost, both of which can be explained relative to the blockchain trilemma or trade-off between scalability, decentralisation and security.

Ethereum & Transactions

The Ethereum blockchain is highly decentralised, providing enhanced security because with a larger network of nodes, it is more difficult for a malicious actor to achieve a 51% or DDOS-type attack. On the other hand, this inherently inhibits scalability as it takes a lot longer for every node on the network to reach consensus on each consecutively processed block.

As a result, Ethereum can process approximately 12-15 transactions per second (TPS). At times when there is increased demand for transactions on the Ethereum network, the nodes are unable to handle this throughput. The resulting bottleneck causes latency, delayed transactions and a rapid increase in Gas fees demanded by the network.

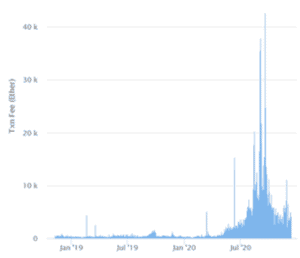

Fig.1 Ethereum Network Transaction Fee Data (source: Etherscan)

The growth of DeFi crypto assets and the bull run of major coin markets in Q3-Q4 2020 have contributed to the large spike shown in Fig.1 but historic data throughout 2019 shows fluctuating transaction costs and intermittent spikes. This will inhibit long-term adoption as companies cannot reliably determine the running cost of applications on the Ethereum Virtual Machine (EVM).

An average transaction fee in September 2020 was $7.5 USD which is barely competitive with traditional fiat currency transfers for cross-border payments and settlement. It also cannot compete with alternative blockchain 2.0 protocols; in mid-2019 the cost of a transaction was still typically >£0.10 USD on Ethereum while on Stellar, fees were ~$0.01 per 5,000 transactions.

This brief comparison and the fluctuating transaction fees of Fig.1 show that Ethereum has a significant scalability issue which will need to be overcome if the platform is going to maintain the market dominance it has enjoyed for several years.

Ethereum Foundation: What is the plan?

The Ethereum Foundation has planned several adaptations to address both scalability and cost. One is sharding, whereby certain apps and assets can be processed on different side-chains that run concurrently with the main Ethereum ledger. There are also a range of secondary layer solutions for Ethereum scalability. Similar to the lightning network of Bitcoin, low value transactions can be confirmed off-chain before being grouped and submitted to the main blockchain ledger.

However, the primary change to enhance both of the above solutions will be the change in consensus mechanism. A proof-of-stake (PoS) mechanism is the most popular alternative to PoW systems and has always been on the Ethereum roadmap. Instead of all mining nodes expending energy in a race to complete the same algorithm, certain masternodes or validators stake crypto assets at a network address in return for a chance to propose block data or confirm it.

PoW prevents collusion as it is not economical for miners to expend such a large amount of energy (or work) to pass a fraudulent transaction, while PoS prevents collusion as validators risk penalties or complete loss of their staked assets. The new consensus mechanism will therefore make Ethereum significantly faster and more energy efficient.

From Proof of Work to Proof of Stake

Ethereum 2.0 validators will have to stake 32 ETH and run the 2.0 client software. They will then earn an ETH reward each time they are randomly selected to propose or validate blocks. The reward is decreased when a validator goes offline (to encourage consistent participation) and the stake is slashed if a validator is found to be introducing a fraudulent transaction or compromising the network.

Vitalik Buterin estimates that in combination with current secondary layer solutions, the Ethereum mainnet capacity may be increased 200-fold by PoS and sharding to enable 2500 TPS or more. However, these changes are a large undertaking that will be implemented over several phases:

Phase 0 – (1st December 2020)

Beacon Chain launched (successfully with over 21,000 validators) to form a registry of validators and deploy the PoS consensus mechanism to run concurrently with the PoW mainnet.

Phase 1 – (2021)

PoS sharding will be introduced, launching 64 shard chains, running concurrently and each with the same throughput as Etherum 1.0. An interim update (Phase 1.5) will then turn the Ethereum mainnet into a PoS shard.

Phase 2 – (2022)

Full shard functionality will be enabled for cross-shard transfers including deposits, withdrawals and smart contracts needed for the development of new 2.0 apps.

The 2.0 update is only in Phase 0 so there are still challenges to overcome and potential issues that may arise. PoS systems such as EOS (which uses delegated PoS where validators are elected democratically rather than at random) are often criticised for being too centralised. But the sheer size of the Ethereum PoW mainnet makes it well placed to develop a highly decentralised PoS network which it has now done with a minimum size of 16,384 validators. This is hardly comparable to the concerningly limited 21 dPoS masternodes of EOS.

Ethereum 2.0: What are the risks?

The introduction of any new technology will always bring security concerns due to the risk of vulnerabilities being overlooked by the development team. In response to market concerns, The Ethereum Foundation is expanding a dedicated security department and multiple security audits are already being undertaken by leading firms such as Least Authority. However, the phased implementation over 1-2 years will provide a good opportunity for any such vulnerabilities to be identified and eliminated.

A less paranoid and more concerning criticism is that the enhanced performance of the 2.0 update will not be sufficiently scalable for Ethereum to regain their competitive edge. There are already numerous future updates planned but, given the rapid growth experienced by the blockchain and crypto asset sectors, it is uncertain whether platform throughput will be able to keep the same pace. By the time Ethereum 2.0 is fully operational in 2022, an estimated 2,500 TPS may be incapable of processing the requested data transactions or eliminating the exorbitant fees from which it is already suffering.

It has to be said that despite the significant flaws outlined for the proof-of-work mainnet, the majority of new crypto assets and blockchain DApps have still flocked to Ethereum. The historic establishment of the platform provides substantial resources to new projects including: open source code, tight-knit communities, skilled developers that are familiar with the proprietary language, Solidity, and a wide range of interoperable technologies from wallet storage solutions to exchanges.

While these factors will undoubtedly continue to draw widespread adoption, the 2.0 update only has the potential to address the long-standing criticisms of the Ethereum community. It is yet to be seen whether their effect will enable the platform to maintain market dominance, or even keep up with the rapid growth of the crypto asset industry.

References

CoinShares Research, Consensys , Decrypt, Crypto Briefing

[…] Ethereum 2.0: Explanation & Assessment – 2020 Update […]