Today we’re going to be taking a deep-dive into cryptocurrency Atomic Swaps. We’ll take a look at the following points.

- The definition of atomic swaps

- The core concepts behind it

- Example

- Video

- Jargon Take Away*

Definition

Atomic swaps utilize blockchain smart contracts technology in order to facilitate the exchange of one form of cryptocurrency for another. This is done without using a centralized entity, such as an exchange.

The exchange of assets between different blockchains can be conducted either on-chain or off-chain

Since then many other swaps have successfully been completed, including Bitcoin’s Lightning Network, the Ethereum network and more.

Concepts

Interestingly, despite the ease with which cryptocurrency ledgers can tokenize assets, facilitate cross-border payments, and even reach consensus in space; the business of swapping digital currencies that exist on different ledgers has remained difficult.

Interoperability between networks has been slow. Therefore, the efforts of protocol’s such as

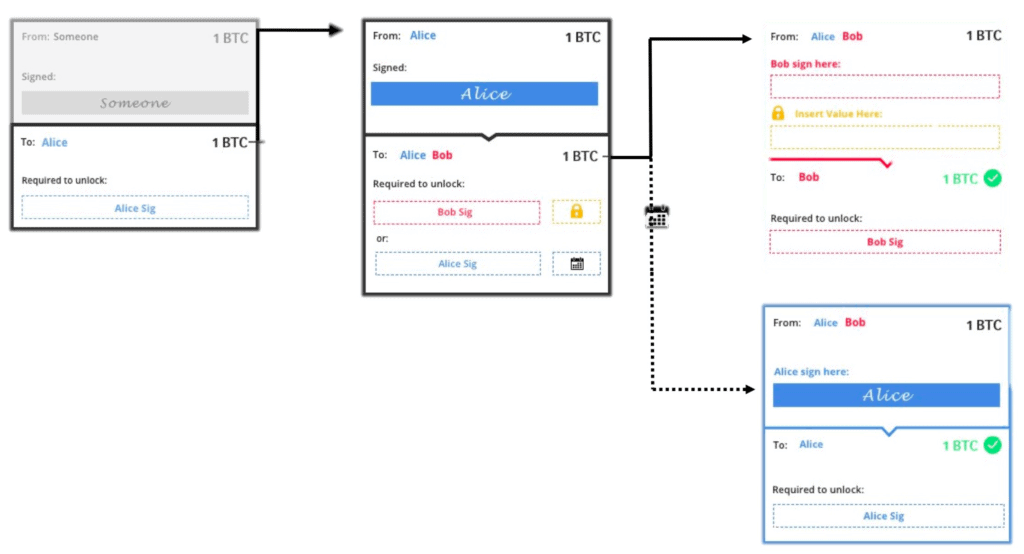

To get around counterparty risk atomic swaps use Hash Time Lock Contracts* (HTLC).

Example

Bob and Alice

Bob wants to exchange 2 ETH for the equivalent DCR. Bob has to first submit his transaction to the Ethereum blockchain. Then, Bob generates a number for the cryptographic hash function to encrypt the transaction. Alice follows exactly the same steps as Bob, submitting her transaction to DCR’s blockchain.

‘This specific swap process is much more suited to larger trades that do not require a particularly low latency of high frequency speed’

Bob and Alice unlock their funds by using their respective numbers, within a specific timeframe. If they do so, the on-chain swap of Bob’s ETH for Alice’s DCR will succeed. Both Bob and Alice can use any relevant form of atomic swap channel, such as a layer 2 solutions like the Lightning Network in order to process an off-chain exchange.

Interestingly, on-chain atomic swaps are not necessarily useful in all cases. According to Decred’s blog the process is much more suited to larger trades that ‘do not require a particularly low latency of high frequency speed’. Because the transactions are bound by the mining of blocks, users are limited by ledger confirmation times, which can be minutes or hours at worst.

Conclusion

Many developers are currently working on both channel scaling solutions and chain interoperability. In order for the cryptocurrency ecosystem to deal with the lack of standardization, atomic swaps are a crucial necessity in order

Some critics may argue that the locking up of digital assets in order to facilitate such swaps creates the very problem of

Still unclear?

Jargon Take Away

Hash Time Lock

Nostro/Vostro accounts

On-chain and off-chain transactions : On-chain transactions refer to the cryptocurrency transactions occurring on the blockchain (meaning on the records of the blockchain) – and remain dependent on the state of the blockchain for their validity. All such on-chain transactions occur and are considered to be valid only when the blockchain is modified to reflect these transactions on the public ledger records. Off-chain transactions refer to the transactions occurring on a cryptocurrency network which move the value outside of the blockchain. Due to their zero/low cost, off-chain transactions are gaining popularity, especially among large participants.

Investopedia, Decred, Litecoin, BitcoinIT, IPE, Blockgeeks (Video)

We are a bunch of volunteers and opening a new scheme in our community. Your web site offered us with helpful info to work on. You’ve performed an impressive job and our whole group will probably be thankful to you